Office and Industrial sectors continue to outperform

It is with pleasure that we present our results for the six months to 31 December 2018 which show further progress of Growthpoint’s strategy to own well-leased, well-located commercial real estate that contribute to growing income returns for our Securityholders.

Download this results overview as a PDF

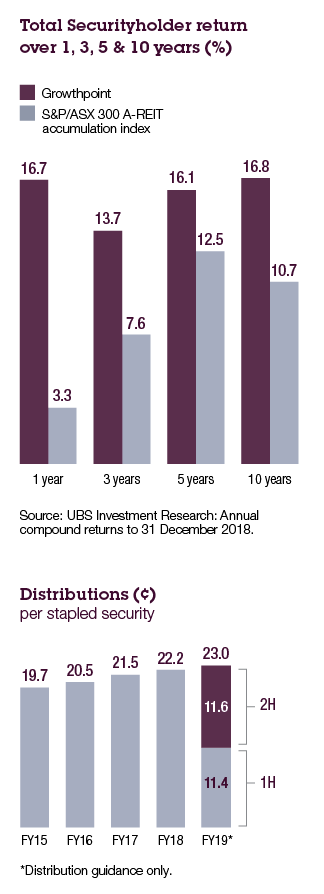

Our continued focus on acquisitions, portfolio repositioning and property enhancement helped deliver funds from operations of 12.5 cps, the same as the prior corresponding period, and a distribution to Securityholders of 11.4 cps, a 3.6% increase on the prior corresponding period. This places us well on track to meet our upgraded FY19 FFO guidance of at least 24.8 cps and FY19 distributions of 23.0 cps.

Our continued focus on acquisitions, portfolio repositioning and property enhancement helped deliver funds from operations of 12.5 cps, the same as the prior corresponding period, and a distribution to Securityholders of 11.4 cps, a 3.6% increase on the prior corresponding period. This places us well on track to meet our upgraded FY19 FFO guidance of at least 24.8 cps and FY19 distributions of 23.0 cps.

Statutory profit for the period was $188.8 million, down 8.9% on the prior corresponding period, with property revaluation gains offset by the non-repeat of profits generated from asset sales in the prior corresponding period.

We successfully completed several significant transactions in the half year, including the acquisition of 100 Skyring Terrace, Newstead, QLD for $250 million (before acquisition costs) in December 2018, funded in part by a $135 million Rights Offer which achieved substantial support from new and existing Securityholders. The property is a modern, highly green credentialed building, completed in 2014, fully leased with two major ASX-listed tenants. It has a long weighted average lease expiry (WALE) and attractive rental growth profile – characteristics very much in line with the Group’s strategy of delivering income growth to Securityholders.

Settlement of the acquisition of 836 Wellington Street, West Perth, WA occurred in October 2018. This acquisition added another well leased, modern, A-Grade building to Growthpoint’s growing office portfolio, which is now valued at $2.7 billion. The acquisition of West Perth was Growthpoint’s first office investment in Perth and came after a long period of due diligence on the Perth office market. The removal of substantial sub-leasing space from the market over the past 12-18 months along with subdued recent development activity provides for a more attractive entry point into the Perth office market.

These acquisitions continue Growthpoint’s portfolio and income enhancement strategy. Growthpoint owns the largest metropolitan office portfolio in the A-REIT sector, together with CBD office assets and a large industrial / logistics portfolio totalling $1.2 billion. The acquisitions add to the defensive characteristics of the portfolio, which include a history of high occupancy levels, a long WALE and quality listed company and government tenants.

Construction has commenced at Botanicca Corporate Office Park in Richmond, VIC for a new office development comprising approximately 19,300 square metres (sqm) of A-grade office accommodation across two towers. The development is tracking ahead of schedule with completion expected in the first half of 2020. We are receiving strong engagement from a number of prospective tenants and will update the market as leasing progresses.

In January we welcomed the opportunity to again partner with Woolworths in the expansion of one of their key distribution centres at Gepps Cross, SA. Under the terms of the agreement, Growthpoint is funding the $57 million development and will receive a coupon for the project costs as they are incurred at a yield of 6.75% p.a. Upon practical completion the lease over the entire property will reset to 15 years.

As part of the overall transaction, Growthpoint has also agreed with Woolworths to an early surrender of its lease at 120 Northcorp Boulevard, Broadmeadows, VIC. Our long-standing relationship with Woolworths across multiple sites was a factor in achieving what is an excellent result for both parties and we look forward to working with Woolworths on the Gepps Cross expansion.

The portfolio again achieved strong valuation gains as investor demand for quality office and logistics assets remained high. Positive transactional evidence and improving market rents were the main drivers, with valuation gains strongest in New South Wales and Victoria. In aggregate, the book value of the property portfolio increased by $163.4 million equating to a 4.9% increase on a like-for-like basis over the half. The positive spread between long-term bond yields and property yields suggests healthy appetite for well-leased commercial property will remain in the near-term.

Valuation gains and equity raised in HY19 helped gearing (35.0%) remain at the bottom of the target range. Proceeds raised from asset sales planned in the second half of FY19 are expected to reduce gearing further (provided current market conditions persist). Outside any significant transactions, a significant change in the property market or the wider economy, management and the Board expect to maintain gearing toward the lower end of the Group’s target gearing range in the period ahead.

After a strong start to FY19 we are confident in the outlook for the remaining six months of the financial year. Growthpoint remains committed to achieving continually growing income returns and long-term capital appreciation for Securityholders and we thank investors for their ongoing support.

Geoff Tomlinson, Independent Chairman & Director

Timothy Collyer, Managing Director

Growthpoint Properties Australia Limited