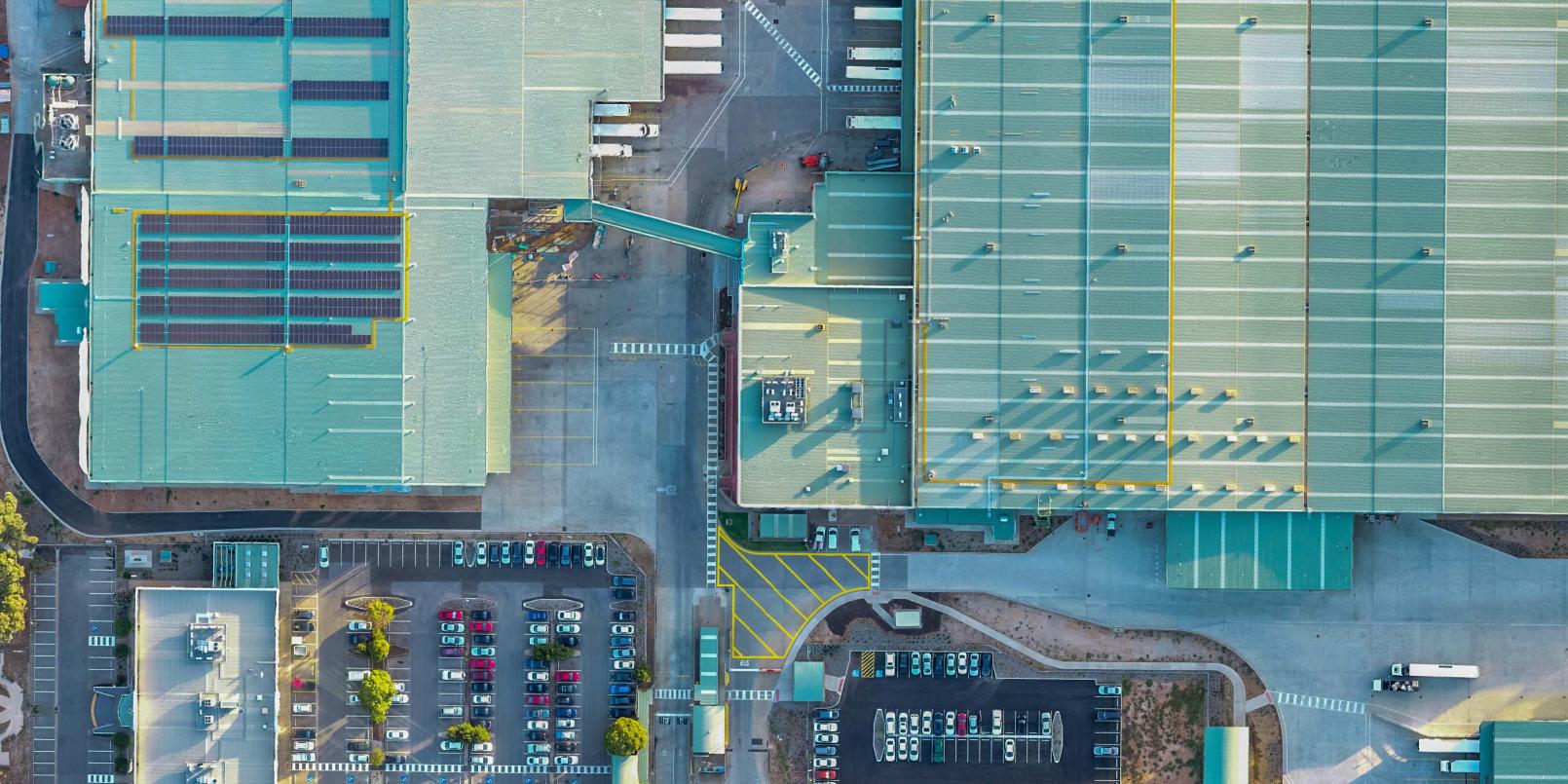

Growthpoint creates value beyond real estate. Since 2009 we’ve been investing in high-quality industrial and office properties across Australia.

$ 5.4 b

Total assets under management*

6.7 %

Direct portfolio WACR

5.6 yrs

Direct portfolio WALE

95 %

Direct portfolio occupancy

Investor centre

Our funds

Closed

Growthpoint Australia Logistics Partnership (GALP)

A capital partnership with TPG Angelo Gordon, focussing on growth through acquisition of logistics assets in Australa

Closed for investment

Closed

Growthpoint Canberra Office Trust (GCOT)

An unlisted wholesale syndicate trust which owns 2 Constitution Avenue, Canberra, ACT, an A-Grade CBD office building predominantly leased to Government tenants.

Closed for investment