After a 2-year devaluation cycle, where are the best opportunities now in Australian commercial real estate? We believe some of the best returns are in the Brisbane office market.

Some of the drivers that make the Brisbane office market attractive right now include:

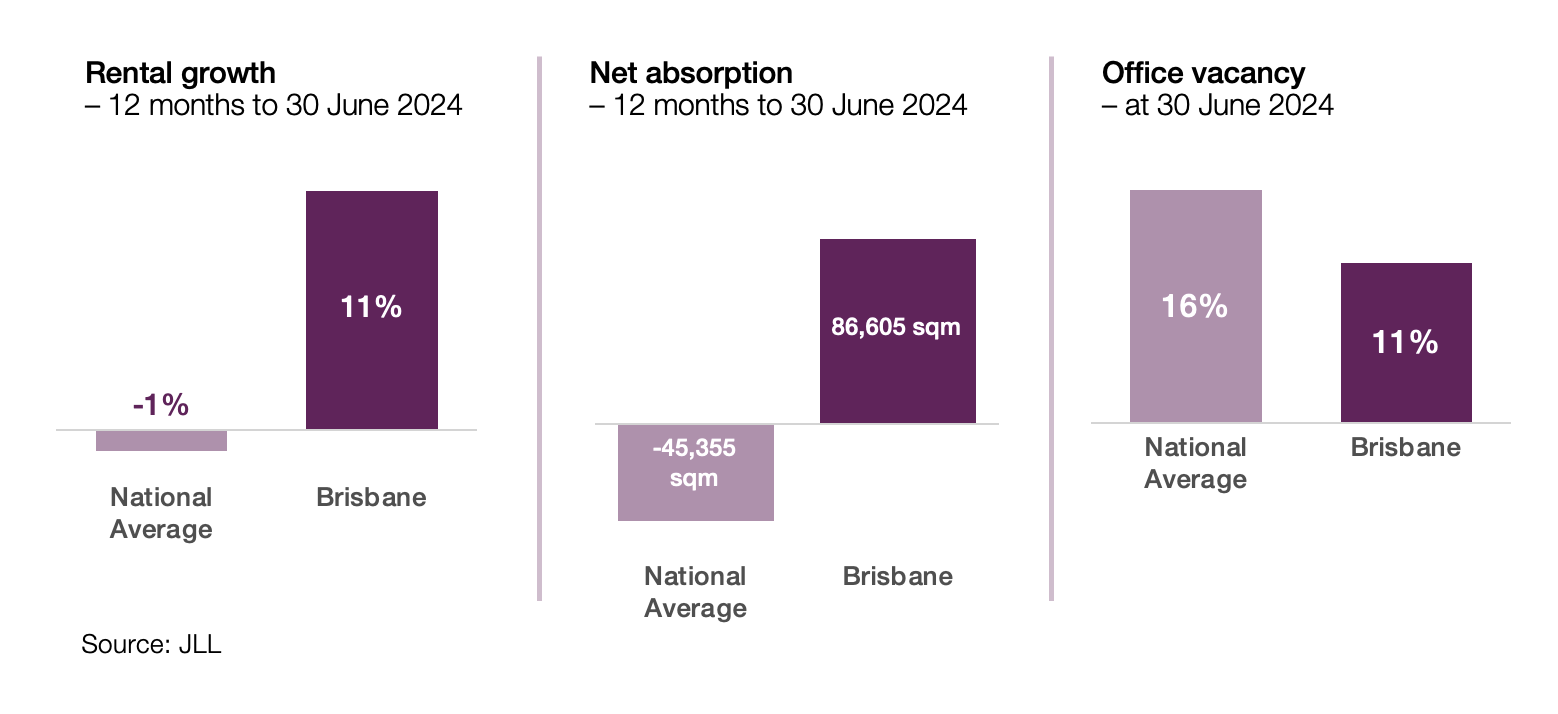

- Vacancy rate of 11% vs national average of 16%

- Rental growth of 11% vs national average of -1%

- Strongest net absorption across all Australian office markets

- Attractive yields relative to Melbourne and Sydney, representing a good entry point

- High construction, labour and finance costs are deterring new supply, most notably in the fringe markets

- Limited supply additions are expected to be exacerbated by large Government infrastructure projects

- Economic rents for new developments are considerably higher than existing rents

- A deep pool of large occupiers including Government tenants

- Population growth exceeds national average

Growthpoint is a strong believer in the Brisbane office market. We have extensive experience through our acquisition and management of eight office assets valued at over $800 million. In the past two years we have leased c.45,000 sqm of office space across 60 transactions.

Our highly experienced team is actively looking at opportunities in the Brisbane office market for private wholesale and institutional investors, if you are interested, please get in touch with Catherine Farrell, Manager, Investor Relations at Growthpoint Properties Australia.